Mobility Business Models in Times of AI And Digitization

An overview of technological trends in the transformation of the mobility market and underlying business models

Max Erdrich

9.7.2018

An overview of technological trends in the transformation of the mobility market and underlying business models

WHILE the traditional business model for car manufacturers has remained unchanged for more than a century, it is now faced with changing market characteristics. Decreasing ownership rates for instance present both risk and opportunity for automotive incumbents and prepare the ground for new service-based players in the mobility market.

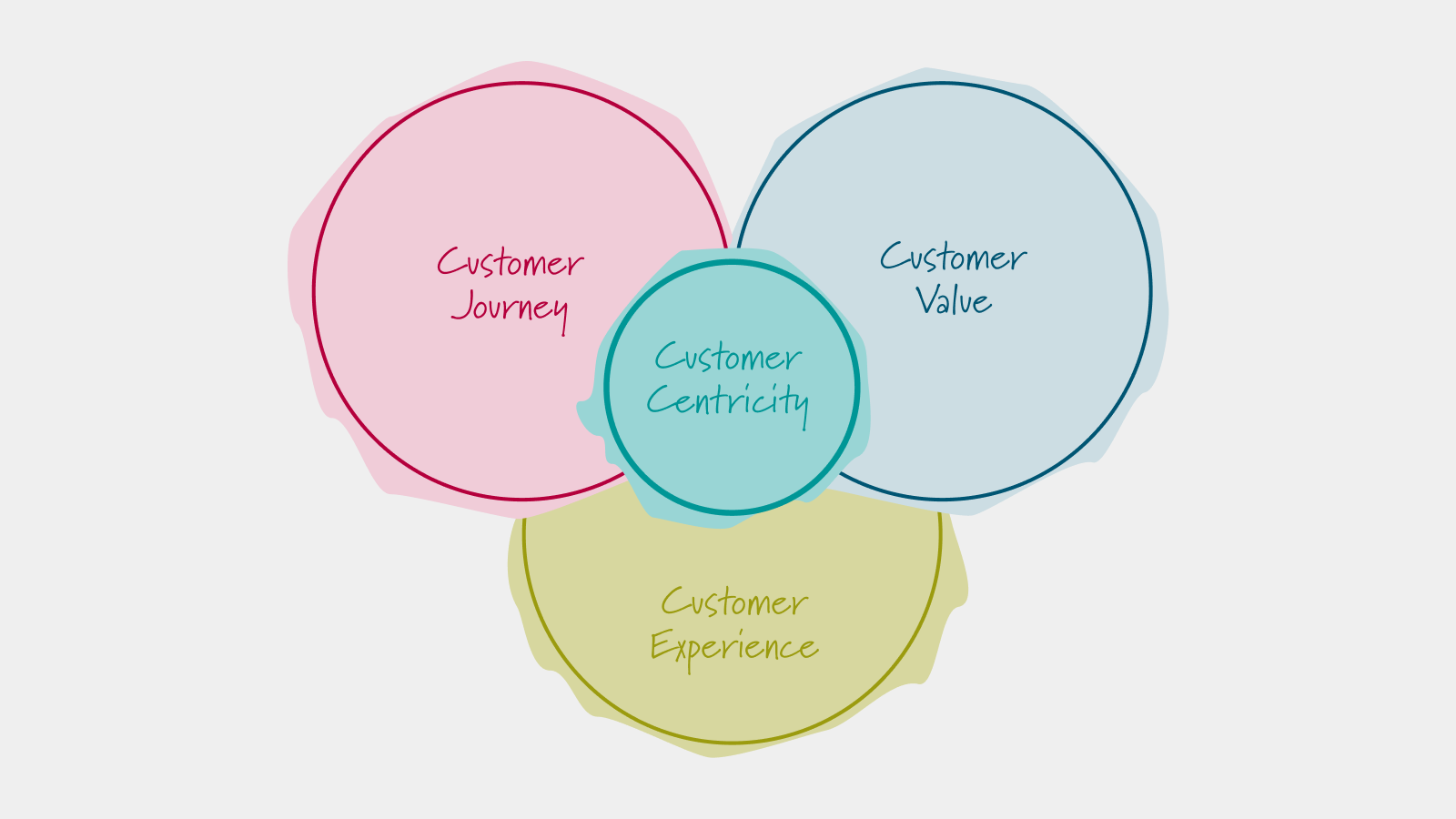

The rise of an increasingly customer-focused service economy paired with technological developments such as digitization and artificial intelligence is currently unlocking opportunities to drive the mobility ecosystem into a new era of service- and utilization-based business models.

This blog post looks at how technological trends already have and will continue to transform the mobility market and underlying business models.

So far car manufacturers were placed on top of the pyramid, spending heavily on vehicle R&D to make engines more powerful and efficient, while the underlying technology of the combustion engine remained relatively unchanged. Sourcing and supply chain strategies were optimized as globalization gained momentum and the variety of car models increased. Elaborate distribution networks consisting of multiple car dealers ensured that vehicles would reach consumers without manufacturers having to deal directly with them. Moreover, corporations invested heavily in brand advertisement in order to reach customers in their target markets.

But change is inevitable – with the rise of new technologies, having created a whole new digital industry, it was only a matter of time until the automotive sector would be impacted.

Digitization and artificial intelligence, to pick prominent trends, are rapidly driving the creation of new business models. And while car manufacturers might have been focused on deciding which engine technology to invest in (e.g. hybrid, electric, hydrogen-powered cars), companies like Tesla and Uber opted for holistic approaches to develop innovative business models that capitalize on current trends, thus securing a competitive advantage on the market.

Step-by-Step Innovation of Business Models

Tesla chose a model that tackled each building block of established players, by focusing on electric vehicle innovation and vertically integrating key components like batteries built in its own factory. Apart from showrooms in prime locations of trending cities, Tesla uses digitization to perform over-the-air software updates and maintain a direct relationship with its customers during the purchasing and maintenance process.

Even though Tesla is actively working on autonomous vehicles and new shared vehicle business models, the company is still committed to a rather traditional automotive business model focusing on electric vehicle innovation and digitization. The business model still carries a higher risk as it requires greater investment in infrastructure and R&D activities. However, the rewards can be greater too since Tesla is building an innovative brand image providing better value to customers than the existing car manufacturers with their electric and digitally integrated vehicles.

Radical Innovation of Business Models

Uber took a more radical approach to mobility by not focusing on selling vehicles but on selling miles. Making full use of digitization and urban mobility trends, Uber stepped into the existing industry as a platform operator, establishing a brand facing the customer directly and placing itself above existing car brands.

Even though Uber has no direct control of which cars are used by drivers that operate on the platform, the brand has interrupted the direct link from car manufacturers to its customers – this is obviously limited to Uber’s operating areas mainly in urban areas.

The change is transformational to the mobility market and it is not limited to the car manufacturing business. The traditional taxi industry is confronted with a new set of drivers operating under a corporate umbrella that is taking care of a seamless mobility experience for the customer. Uber is filling a gap between the high cost and maximum flexibility car-ownership and a multimodal solution, consisting of low to medium cost-intense and less flexible public transport/taxi solutions.

Platform solutions, in the mobility sector known as transportation network companies, are a result of the availability of live data (e.g. vehicle location, fleet utilization, fuel level), interconnected services and increased desire for an optimized user experience (e.g. vehicle on demand, accessibility via mobile devices, free choice of vehicle type).

Implications For The Traditional Business Model

Driven by a rapidly evolving ecosystem (regulations, environmental awareness, platform economics, etc.) in which traditional car manufacturers operate, new business models have emerged as shown above. In order to stay ahead in the game manufacturers need to keep the following developments on their radar and adjust or reinvent their business models accordingly:

Sharing Economy: Vehicles no longer have to be owned by single persons but can be shared amongst many users even on individual trips. As long as autonomous vehicles are not fully permitted on public roads, drivers, car sharing companies and platform operators will build their businesses around the sale of miles. This trend might reduce the number of cars needed, but it will also shift the focus of car characteristics such as replacement cycles for parts or the total cost of ownership.

Focus on User Experience: There are multiple possibilities to increase the user experience, one example is by integrating digital services (e.g. on-demand in-car entertainment) which work seamlessly with smartphones and other devices. Once vehicles are mainly used for car-sharing and therefore generate profit per mile, the customer focus will shift towards a new user: the passenger (no longer the driver). This trend will peak once cars become autonomous.

Shorter technological life cycles: As seen in the consumer goods sector, new features will enter vehicles faster, increasing the rate of technological improvement. Cars may for example be designed in a modular way such that some parts can be replaced more frequently than other (improved) parts. Software built on top of this hardware will update at an even higher rate – creating a need for over-the-air updates that Tesla is already capable of.

Technological Trends

The rise of the service economy, supported by the above-mentioned developments, has driven the evolution of business models across the mobility industry. Car manufacturers heard the bell and are already creating new business units or brands to build direct relationships with customers while selling them miles or mobility services rather than vehicles – examples are moovel (Daimler), Car2Go & Drive Now (Daimler & BMW) and Moia (VW).

In a large effort, they are now building up knowledge in areas that are rather new to them, like ride management, electric/autonomous vehicles and digital services. These knowledge areas build on digitization as a key technological enabler and led to the creation of new strategies and business models. Digitization itself is a multifaceted trend, consisting of elements such as business intelligence analytics, the internet of things, big data, deep learning and artificial intelligence. The impact of these trends can be exemplarily observed in practice as the amount of data at a car manufacturer in the vehicle backend has increased by a factor of 30 over the last 4 years.

Once artificial intelligence matures further its impact on the mobility sector will most likely be disruptive and lead to a radically transformed ecosystem.

Digitalization

The rapid pace of digitization is transforming the component hardware-driven automotive sector to a software- and solutions-focused industry, accelerated by consumers’ digital lifestyle and demands for new and innovative services. The future roadmap of digitization in the automotive sector will most likely move from a car-as-a-service to mobility-as-a-service thereby, the car becoming an element of a connected solution.

Looking at the business model from the beginning of this blogpost, digitization in the automotive industry can be defined around two areas:

The first area drives efficiencies in the supply chain, production cycle and distribution process and makes room for service-focused and technologically innovative companies – mainly in the traditional automotive market. In a future connected supply chain, for instance, the combination of IoT data with analytics can provide manufacturers with a common platform to operate with real-time visibility, promoting greater interdependency, collaboration, dynamic responsiveness and the flexibility to integrate disruptive innovations.

The following area with its content creates a whole new dimension to the mobility market. The future of mobility consists of technology-enabled, door-to-door, multi-modal travel, including pre-trip, in-trip and post-trip services to improve the journey experience.

The creation of new business models was already enabled by these trends as shown by Tesla and Uber. And the race for a strong brand facing the customer directly will most likely lead to further business model innovations and strategic partnerships.

Artificial Intelligence

The automotive industry is still only at the beginning of an AI disruption. Current AI applications only have a limited impact. They can already outperform humans, but only in very specific tasks, such as in navigation systems as well as single autonomous driving tasks.

Machine learning will be the technological foundation for AI in mobility and the source of competitive advantage for upcoming years. For instance, machine learning is required for autonomous driving (image recognition) where expert systems based on human programming will not be able to keep up.

Machine learning will unlock entirely new products and value pools and not just lead to productivity improvements. Given consumer interest, there are a number of areas in automotive and mobility where machine learning could be applied. Again, these can be split into two areas:

Upcoming improvements from AI could drive huge competitive advantages in the automotive and mobility market. Imagining autonomous cars in combination with Uber’s already existing customer base would lead initially to a quite dominant role in the urban mobility market until other companies step up with similar offerings. But again, Uber would change its business model, not having the driver as a middleman but buying or leasing the autonomous car fleet directly from respective brands selling miles directly to the customer.

A Look Into The Future of Mobility

Recent developments in other industries (goes for airlines, busses, taxis, etc.) have shown that whenever there are transportation network operators there will be aggregators stepping in on a market, to sum up, all relevant offers and compare prices for the customer. This trend will most likely set forth with the sale of miles on the road.

Car manufacturers and other established players in the mobility sector will need to make sure that their business model is adapting quickly to market trends or to have strategic partnerships in place to maintain their relevance in the mobility market. New players who are better adapted to the new rules of the game (such as Tesla and Uber and tech companies like Google and Apple) already took their spots in the market and forced established players to reinvent the structures that allowed them previously to compete and succeed. This trend sets forth – companies (and this goes for new and existing companies) need to position themselves at the forefront of change as it is happening now and at a never-before-seen pace.

Workshops

Resources

All Rights Reserved.